National Hispanic Heritage Month is celebrated annually in the United States from September 15 to October 15. During this time, Americans of all backgrounds celebrate the histories, cultures, and contributions of people whose ancestors came from Mexico, the Caribbean, Central and South America, and Spain.

If the timing seems odd, this celebration begins in the middle rather than the start of September because it coincides with national independence days in Guatemala, Honduras, El Salvador, Nicaragua, and Costa Rica (Sept. 15). The honorary month also overlaps with the national independence days of Mexico (Sept. 16), Chile (Sept. 18), and Belize (Sept. 21)

Table of Contents

A Fast-Growing Presence in the U.S. Housing Market

According to the U.S. Census Bureau, there were roughly 62.6 million Hispanic people in the U.S. in 2021, making up 19% of the nation's population. This is up from 16% in 2010 and just 5% in 1970.

As this population continues to increase organically through births and migration, many are purchasing homes. In 2022, the Hispanic homeownership rate increased to 52.23%. According to the National Association of Hispanic Real Estate Professionals (NAHREP), 2022 marks eight years of consistent homeownership growth for Hispanic households.

A Closer Look at the Hispanic Lending Market

In celebration of Hispanic Heritage Month, iEmergent and Certified Credit have teamed up to take a closer look at the challenges faced by Hispanic homebuyers and how they can be addressed by more inclusive credit and lending practices.

For this post, much of the data and analytics come from iEmergent’s Mortgage MarketSmart platform, a web-based visualization tool that combines iEmergent’s robust forecasts, external data sources, dynamic maps, and simple tools to help lenders focus on homeowner diversity and growth efforts.

First, the good news. In spite of record-breaking affordability challenges, as home price appreciation and interest rates continued to rise, the number of Hispanic loans is steadily increasing.

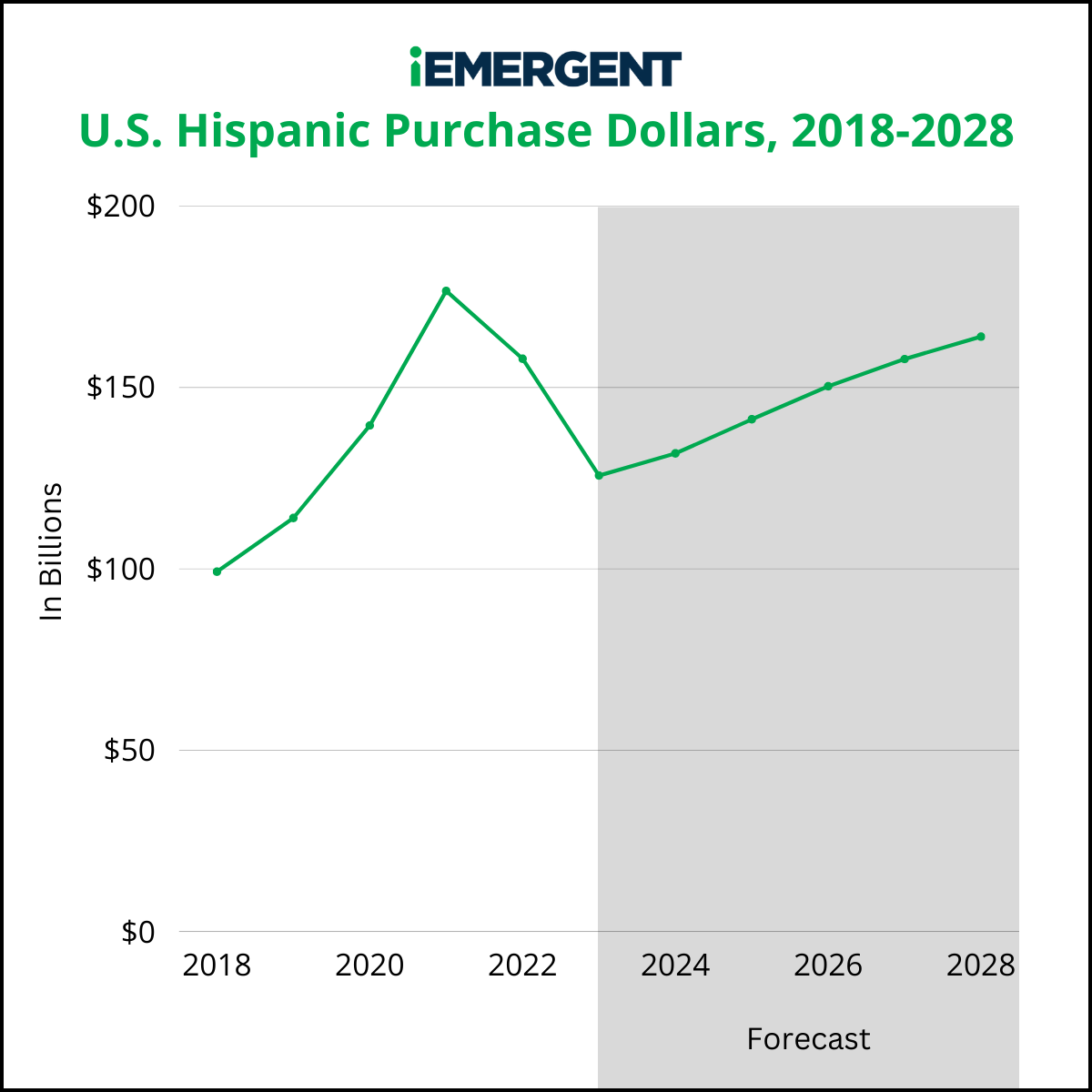

As visualized in the chart below, 2021 was a big year for Hispanic borrowers. Since then, purchase loan numbers and volumes have decreased slightly, but they still remain strong. These patterns follow national trends, which also saw a large increase in 2021 from the COVID boom followed by stabilized, steady growth. iEmergent anticipates that Hispanic homebuyers will round out 2023 with 369,916 mortgage loans worth $125.7 billion.

National Numbers for Hispanic Purchase Loans

Looking at the 11-year period surrounding 2023, Hispanic lending is expected to follow a similar trajectory to the market as a whole for the same time period.

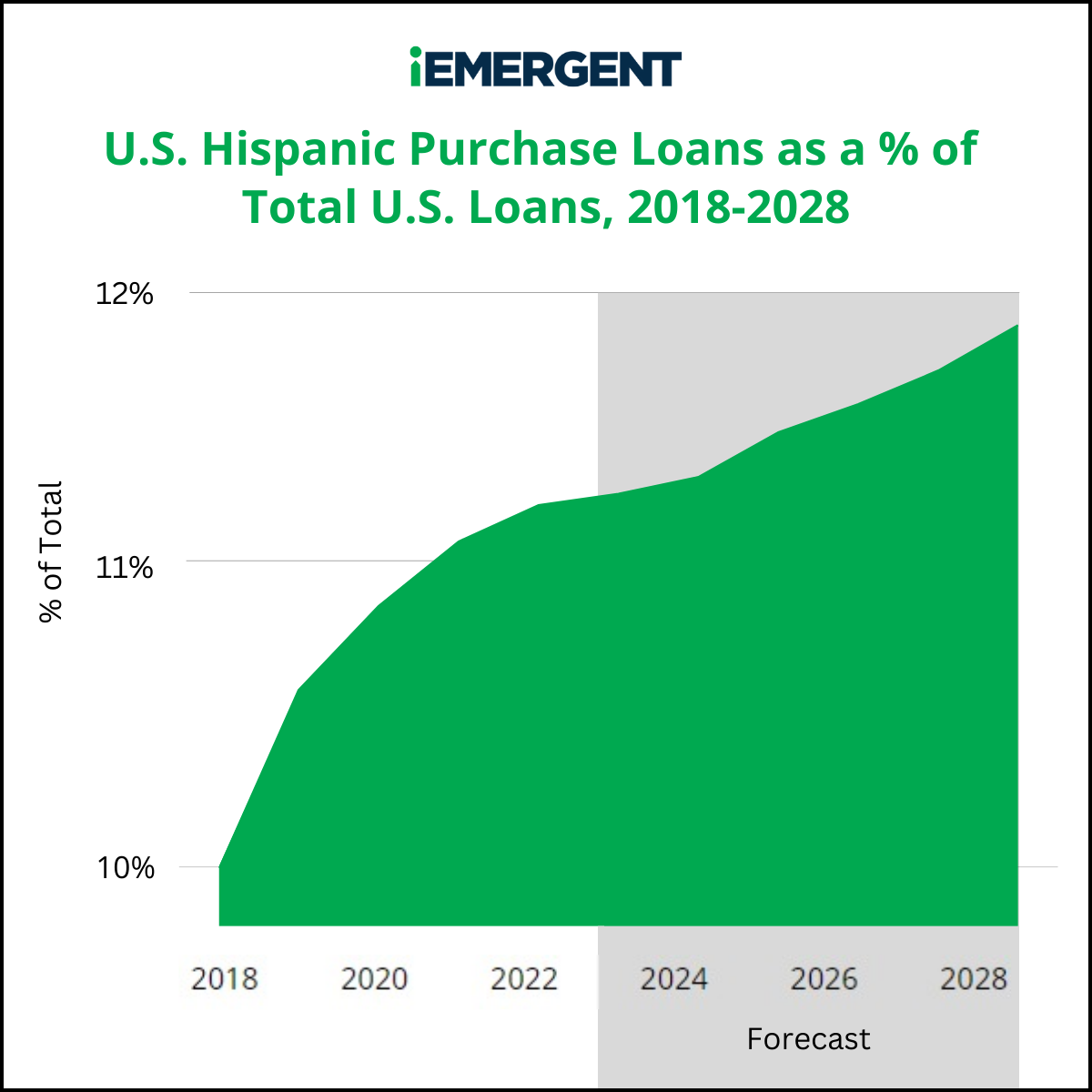

Percent of Hispanic Purchase Loans Nationally, Compared to Market

Hispanic loans and dollars continue to increase as a percentage of overall market share with consistent growth from 2018–2022 and continued growth forecasted through 2028.

What’s Holding Some Applicants Back?

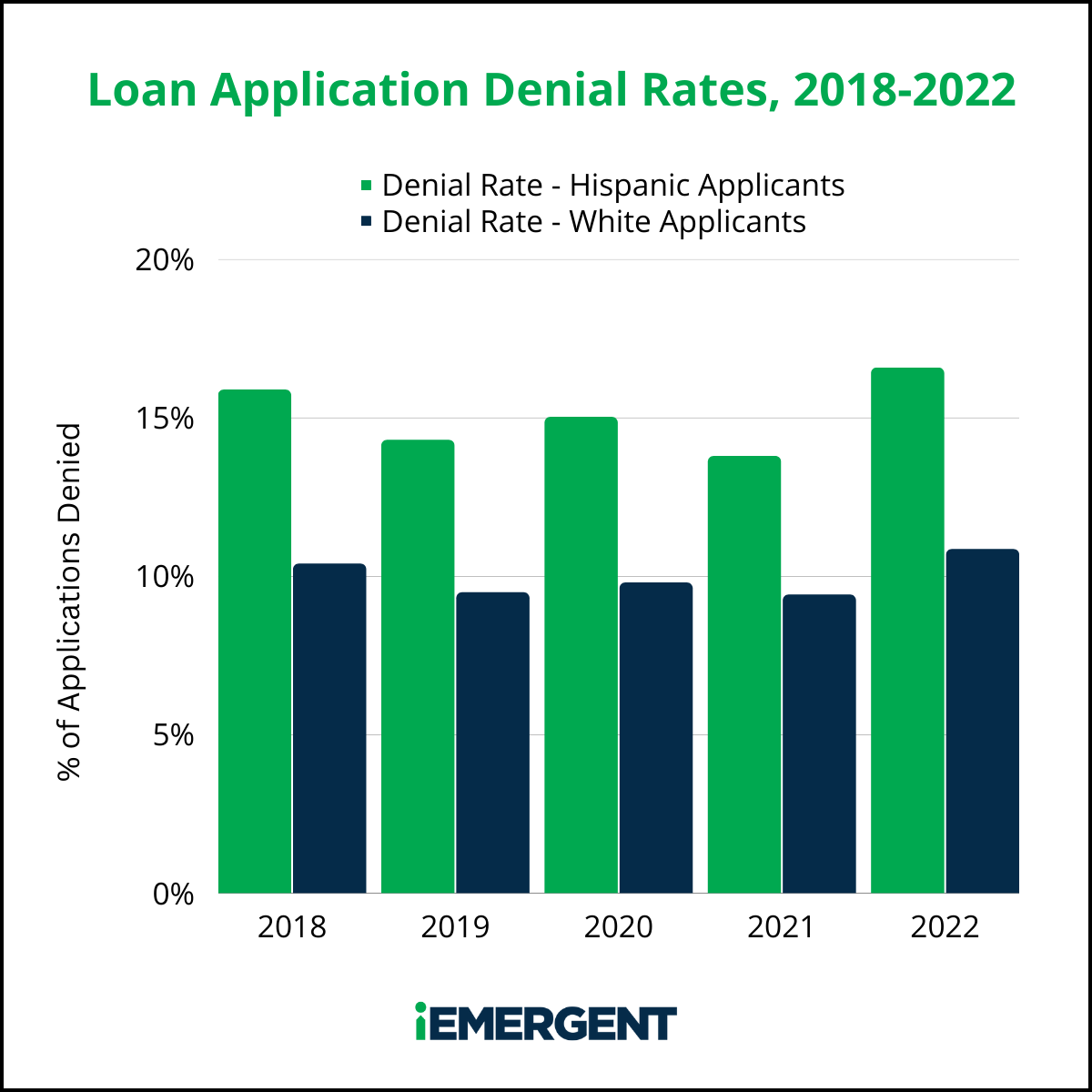

In 2022, 16.58% of Hispanic applicants were denied home loans, according to iEmergent data. For context, during the same year, 10.86% of white applicants were denied. Hispanic application denials follow the national trends, increasing and decreasing with the market, but always remaining 4-6% above the denial rate for white borrowers.

Hispanic Loan Application Denial Rates

Lenders deny loans for all kinds of reasons, and credit history is the second leading cause of mortgage application denials for Hispanic consumers. While credit scores do not factor in age, race, income, or place of residence, the financial factors that are used to calculate credit scores can disproportionately affect certain racial groups.

For Hispanic applicants, the top denial reasons, in order of frequency, are:

-

- Debt-to-income ratio

- Credit history

- Employment history

- Collateral

- Insufficient cash

Improving Approval Odds for Hispanic Homebuyers

As more Hispanic homebuyers pursue homeownership, it’s important for mortgage lenders to learn about their unique needs and concerns. This way, lenders can help Hispanic borrowers qualify for home loans and provide them with an excellent borrower experience.

Here are five strategies from Certified Credit on how to do just that:

#1 Share Educational Content About Credit Online

Credit can make or break an aspiring homeowners’ mortgage eligibility. Unfortunately, Credit 101 isn’t typically included in public school curriculum. Thus, most applicants rely on the credit education they receive from their parents.

For Hispanic Americans, this education may be insufficient. After all, a prominent portion of Hispanic mortgage applicants are the very first person in their family to purchase a home. This education gap may explain why:

-

- 27% of Hispanic consumers are “credit invisible,” which means that they don’t have enough reported credit history to generate a credit score.

- Hispanic home loan borrowers have an average credit score that’s 34 points lower than their non-Hispanic white counterparts.

So, how can mortgage lenders help close the education gap? Sharing informative content online is one effective method. Blog articles, YouTube videos, and TikTok reels are all fantastic ways to reach Hispanic homeowners online.

What Topics Should Mortgage Lenders Focus On?

When creating educational content, mortgage lenders should start with the basics, such as:

-

- What is a credit score?

- What factors make up mortgage credit scores?

- What is a “good” credit score for a mortgage?

- How can someone build credit from scratch?

- How can borrowers increase their credit scores quickly?

- How can borrowers bolster their credit history using alternative credit data?

This foundational information can bring Hispanic borrowers up to speed and empower them along their home-buying journeys. Want more inspiration? Here are eight additional ways you can help your borrower improve their credit score.

#2 Break Down Other Eligibility Factors

Credit is just one part of the mortgage eligibility equation—down payment, debt, income, and employment history are some other key factors.

As with credit, Hispanic homeowners may be at a comparative disadvantage when it comes to these criteria. Hispanic families often have less generational wealth to pass on to their children, making it harder for them to put down ample down payments.

Despite these setbacks, mortgage lenders can help Hispanic homeowners optimize their eligibility by:

-

- Breaking down each home loan program’s minimum down payment requirements

- Highlighting relevant down payment assistance programs

- Explaining debt-to-income ratios

- Discussing the most efficient ways to pay down debt

- Describing each loan program’s employment history requirements

- Clarifying the rules regarding seasonal jobs, secondary income, and self-employment

#3 Engage With Hispanic Communities

While online education is a worthwhile way to connect with Hispanic homebuyers, in-person outreach is also important. By immersing themselves in Hispanic communities, mortgage lenders can gain real-time insight into their prospective borrowers' top challenges, whether that’s fear of rising interest rates or uncertainty about the benefits of buying a home vs. renting.

To forge these in-person relationships, mortgage lenders need to engage with their local Hispanic communities. Here are some ideas:

-

- Host home-buying seminars in Hispanic neighborhoods from time to time

- Attend community events

- Arrange home-buying presentations at local schools and universities

#4 Offer Bilingual Services

Buying a home is already a complex process—it can be even more challenging if you have to do it in your second language. It’s no wonder that 25% of Hispanic homebuyers prefer working with housing professionals who can speak Spanish.

Mortgage lenders can provide a smoother lending experience for their borrowers by hiring bilingual staff. Mortgage lenders should also produce their educational content in both languages and provide Spanish-language lending materials when requested, many of which can be found on Fannie Mae’s website.

#5 Hire More Hispanic Representation

In addition to hiring bilingual staff, it’s beneficial to have team members who possess a culturally-nuanced understanding of Hispanic Americans. Unfortunately, this level of diversity is lacking in today’s lending landscape. While Hispanic purchase originations have increased double-digit percentages each year since 2018, only 7% of mortgage professionals are currently of Hispanic descent.

Mortgage lenders can combat this issue by hiring more Hispanic staff who understand their borrowers’ backgrounds. For example, many Hispanic families live in intergenerational homes. These borrowers may need some extra guidance navigating their credit score, income, employment, and down payment requirements.

Mortgage lenders can also benefit from working with real estate agents and credit reporting agencies that already have plenty of Hispanic staff on hand. Certified Credit is proud to report that 25% of its staff is bilingual, making it an excellent resource for mortgage lenders looking to attract more Hispanic borrowers in the future.

The Bottom Line

To sum it up, Hispanic homeowners are quickly becoming a prominent demographic of homebuyers in the United States. Helping these homeowners enhance their creditworthiness can benefit borrowers and lenders alike.

Paving the way for a more equitable and inclusive housing market requires a multi-faceted approach. As such, lenders, real estate agents, and vendor partners need to work together. By doing so, everyone can expand their business prospects and set themselves up to capitalize on the evolving market conditions.

To learn more about this topic, check out iEmergent’s data forecasts and Certified Credit’s educational resources.

This post also appeared on iEmergent's blog.